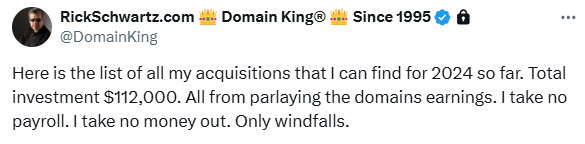

Rick Schwartz, famously known as the “Domain King,” has consistently proven his expertise in domain investing, and his 2024 acquisition strategy thus far exemplifies his seasoned approach. Rather than placing all his funds into a single high-cost domain, Schwartz has chosen to diversify his portfolio with a $112,000 investment, sourced entirely from his domain earnings. His commitment to reinvest his profits, take no payroll, and remove personal financial draws showcases his belief in the potential of each carefully selected domain.

The strategy for this year? A broad, calculated spread of domain names, ranging from high-value keywords and emerging trends to niche sectors that might surprise future buyers. In a single portfolio of 28 domains, Schwartz provides a masterclass in the art of long-term investment, calculated risk, and insightful anticipation of market demands.

The Portfolio Philosophy: The Case for Diversification

For most domain investors, choosing a single premium domain might seem like the path to instant returns. Schwartz, however, operates differently. Rather than investing the entire $112,000 in one domain, he opted to spread it across multiple strategic acquisitions, selecting names that align with diverse industries, technologies, and potential future demand.

“I would rather have an array,” Schwartz explains, noting that he prefers a diversified portfolio that reinforces the strength and scope of his existing domains. By filling strategic gaps, he enhances his chance of significant returns, confident that just one high-value sale could cover all his investments this year. This is a nuanced approach: while every domain carries the risk of fluctuating demand, Schwartz’s experience in balancing low-cost and high-potential names minimizes that risk.

Domain King Bobblehead we made for Rick

The Rising Demand for .AI and Niche Extensions

One noticeable trend in Schwartz’s acquisitions is the growing presence of .AI and other alternative top-level domains (TLDs). The .AI extension has gained traction, particularly as AI technology and applications continue to expand. Schwartz’s portfolio includes names like TheBet.ai and 3DPrinted.ai, targeting audiences in both emerging technology fields and traditional industries exploring artificial intelligence.

This shift toward niche TLDs is part of a larger market evolution. As more industries embrace technology and consumers become comfortable with diverse domain extensions, Schwartz’s choice to include .AI, .CO, and .ME domains reflects a forward-looking view of what could soon be mainstream. By capturing valuable keywords in these spaces, he positions himself to capitalize on the growing relevance of these extensions.

Understanding Domain Investment: The Art of Patience and Timing

Patience is central to Schwartz’s investment philosophy. With a portfolio of this size and breadth, he’s not necessarily waiting for every domain to sell immediately. Instead, he focuses on the potential of one or a few of these names to eventually yield a significant return. Schwartz knows that domain values are influenced by market demand, emerging trends, and the evolution of digital commerce.

For instance, names like Betty.ai and Trick.ai represent high-potential investments, given their relevance to both emerging tech sectors and brand appeal. Schwartz has always emphasized that domains are assets that require time to reach their full potential. His choice to retain a diverse set of domains gives him the flexibility to meet market demands across multiple industries, while his patient approach maximizes his odds of realizing profitable sales.

Spotlight on High-Potential Acquisitions

A few domains in Schwartz’s portfolio stand out as examples of strategic foresight. Let’s look at some domains that capture both industry trends and potential brand identities:

- Betty.ai – $20,088: With artificial intelligence becoming a significant industry, Schwartz has secured a name that’s simple, memorable, and poised for branding potential.

- SmartKitchen.com – $10,123: As smart home technology continues to grow, this domain could appeal to companies innovating in kitchen tech and appliances, a field ripe for digital growth.

- Trick.ai – $24,977: With its playful name and tech-forward extension, Trick.ai stands out as a brand-friendly option, potentially targeting gaming, AR, or other digital entertainment spaces.

Schwartz’s selection criteria are evident here: he seeks names with clear industry relevance, brand appeal, and scalability. Whether it’s a straightforward industry keyword like Biotech.io or a playful concept like Jazzy.ai, each domain serves a potential market need.

Complete List of Rick Schwartz’s 2024 Domain Acquisitions

Below is the full list of Schwartz’s acquisitions in 2024, complete with their purchase prices:

- TheBet.ai – $140

- Sportswager.ai – $150

- Jessi.ai – $308

- Whiskers.ai – $395

- Exotica.ai – $460

- Employed.ai – $807

- 3DPrinted.ai – $898

- Jazzy.ai – $1006

- Chateau.ai – $1136

- Selene.ai – $2345

- Redrock.ai – $2551

- Reconstruction.ai – $2827

- Hoax.ai – $6101

- Betty.ai – $20,088

- Trick.ai – $24,977

- Somox.com – $319

- UltimateSleep.com – $4400

- Gavron.com – $356

- MetLab.com – $2100

- Asian.ai – $8100

- Firehouse.co – $68

- Camgirl.org – $5450

- Bruno.me – $333

- Freakoff.com – $5295

- Biotech.io – $2469

- DesignManagement.com – $1272

- UnionMade.com – $1655

- DogPod.com – $3497

- Parish.tv – $55

- Regenta.com – $2275

- Nftcoins.com – $449

- SmartKitchen.com – $10,123

Each domain reflects Schwartz’s intuitive grasp of market needs and emerging trends. From SmartKitchen.com, which could cater to the expanding smart home market, to Nftcoins.com, appealing to the booming NFT space, Schwartz’s selection shows insight into sectors where demand is likely to grow.

Lessons for New Domain Investors

Rick Schwartz’s 2024 acquisitions offer valuable lessons for anyone interested in domain investment. By reinvesting earnings, building a diversified portfolio, and approaching each purchase with strategic intent, Schwartz exemplifies a thoughtful, patient approach. Here are a few takeaways for aspiring domain investors:

- Prioritize Portfolio Diversity: Rather than putting all resources into a single premium domain, spreading investments across various industries and keywords helps mitigate risk and increase opportunities for returns.

- Focus on Industry Trends: Investing in domains with relevance to emerging technologies or popular sectors can enhance the likelihood of future demand. Extensions like .AI, .IO, and .CO are valuable additions for investors considering market trends.

- Be Patient and Strategic: Domains, much like real estate, often appreciate over time. Schwartz’s strategy illustrates that domains can be seen as assets that require patience and timing to achieve optimal returns.

Rick Schwartz’s 2024 domain acquisitions showcase a strategic approach rooted in diversification, patience, and market insight. By investing across a range of domains, he sets the stage for significant returns, with the potential for a single sale to cover his entire investment. For new and experienced investors alike, Schwartz’s approach offers valuable insights into the world of domain investing, where thoughtful portfolio building and market awareness can lead to remarkable opportunities. His approach stands as a testament to the power of domains as digital assets in a constantly evolving digital landscape.

To your domaining success,

@AndrewHazen & @DomainSuccess